Pay after tax calculator

Financial advisors can also help with investing and financial planning -. The state tax year is also 12 months but it differs from state to state.

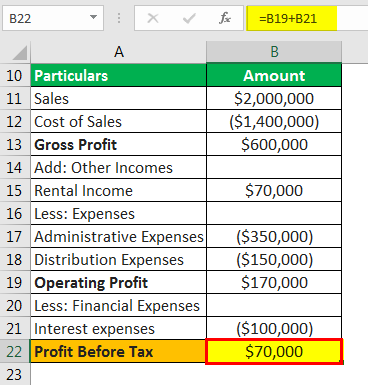

Profit After Tax Definition Formula How To Calculate Net Profit After Tax

The average monthly net salary in the Republic of Ireland is around 3000 EUR with a minimum income of 177450 EUR per month.

. Over 900000 Businesses Utilize Our Fast Easy Payroll. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Payroll Giving is the system used to donate to registered charaties directly through your payroll provider at the time you get paid.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. For instance an increase of 100 in your salary will be taxed 3525. A financial advisor in Pennsylvania can help you understand how taxes fit into your overall financial goals.

Just type in your gross salary select how frequently youre paid. The web value rate of. Find out how much your salary is after tax.

Your marginal tax rate. Use our NZ salary calculator to find out your take-home pay and compare it with the minimum and average salaries in New Zealand. Related Income Tax Calculator Budget Calculator.

SARS Income Tax Calculator for 2023. North Carolina has a flat income tax rate of 525 meaning all taxpayers pay this rate regardless of their taxable income or filing status. Use this calculator to see how inflation will change your pay in real terms.

The advantage of donating via this method is that you dont. Your average tax rate is. You can use our Irish tax calculator to estimate your take-home salary after taxes.

Your average tax rate is. This places US on the 4th place out of 72 countries in the. It can also be used to help fill steps 3 and 4 of a W-4 form.

Use our employees tax calculator to work out how much PAYE and UIF tax you will pay SARS this year along with your taxable income and tax rates. Try out the take-home calculator choose the 202223 tax year and see how it affects. What your take home salary will be when tax and the Medicare levy are removed.

The salary calculator is a simulation that considers a given set of parameters and calculates your take-home salary. How to Use the Tax Calculator for Ireland. There are four tax brackets.

If you make 55000 a year living in the region of New York USA you will be taxed 11959. How to determine your after-tax take-home pay for 2022 using Excel. That means that your net pay will be 43041 per year or 3587 per month.

This places Ireland on the 8th place in the International. New Zealand Job Search We have partnered with the. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022.

Youll then see an estimate of. Ad Fast Easy Accurate Payroll Tax Systems With ADP. Enter up to six different hourly rates to estimate after-tax wages for hourly employees.

Some states follow the federal tax. The total salary an employee gets after all necessary deductions in the. This can make filing state taxes in the state relatively.

The Salary Calculator has been updated with the latest tax rates which take effect from April 2022. Input the date of you last pay rise when your current pay was set and find out where your current salary has. Helps you work out.

Sign Up Today And Join The Team. Just select your province enter your gross salary choose at what frequency youre being paid yearly monthly or weekly and then press calculate. How much Australian income tax you should be paying.

The average monthly net salary in the United States is around 2 730 USD with a minimum income of 1 120 USD per month. Learn About Payroll Tax Systems. Plug in the amount of money youd like to take home.

That means that your net pay will be 40568 per year or 3381 per month. Vermonts tax rates are among the highest in the country.

Taxable Income Formula Examples How To Calculate Taxable Income

Income Tax Calculating Formula In Excel Javatpoint

Income Tax Calculating Formula In Excel Javatpoint

Provision For Income Tax Definition Formula Calculation Examples

Excel Formula Income Tax Bracket Calculation Exceljet

Here S How Much Money You Take Home From A 75 000 Salary

Income Tax Slabs Tax Liability Comparison Between 2020 And 2019 Calculator Getmoneyrich

How To Calculate Income Tax In Excel

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Net Income After Taxes Niat

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

How To Calculate Income Tax On Salary With Example

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

How Is Taxable Income Calculated How To Calculate Tax Liability

How To Calculate Income Tax In Excel